Current Issue

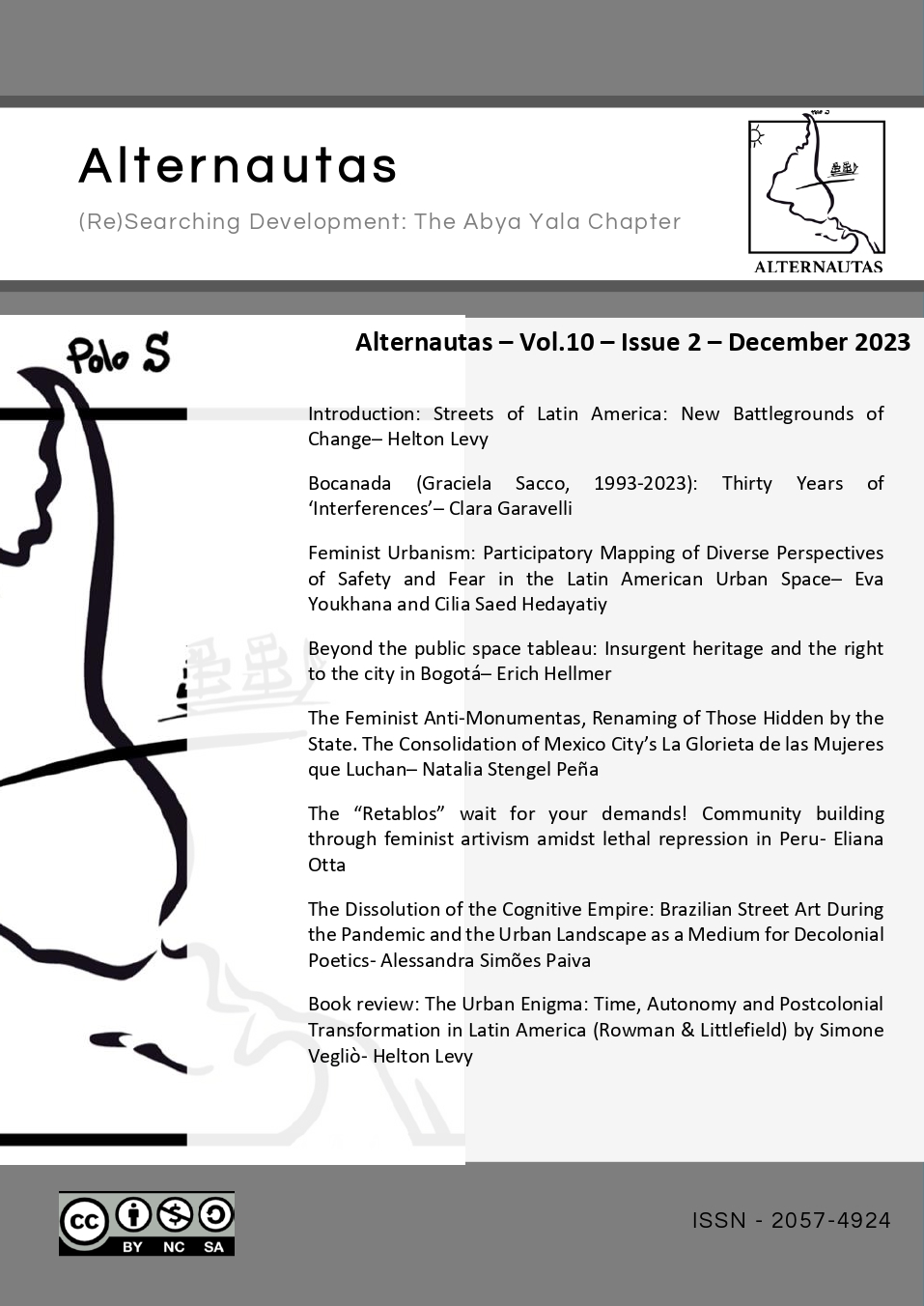

Vol. 10 No. 2 (2023)

Published December 21, 2023

Alternautas is a multi-disciplinary journal devoted to counter-balancing mainstream understandings of development in/from Latin America – Abya Yala. Alternautas emerges from a desire to bridge language barriers by bringing Latin-American critical development thinking to larger, English-speaking audiences. The journal covers a broad range of development issues in a mix of regular and special issues. The journal was launched in 2014 and is fully open-access without fees for readers or authors.

4 Days avg. from Submission to First Editorial Decision (2022)

Editorial

Articles

4-32

33-61

62-92

93-118

119-150